Llc Buyout Agreement Form Template. An LLC Operating Agreement is a legally binding business document that entails the ownership of its members, how the company is managed, and the structure of the LLC (Limited Liability Company). It is a form that documents an agreement so that each party ensures fair treatment during the transaction.

One of the benefits of forming an LLC is the flexibility of managing your business.

It includes a detailed description of the property and warranty.

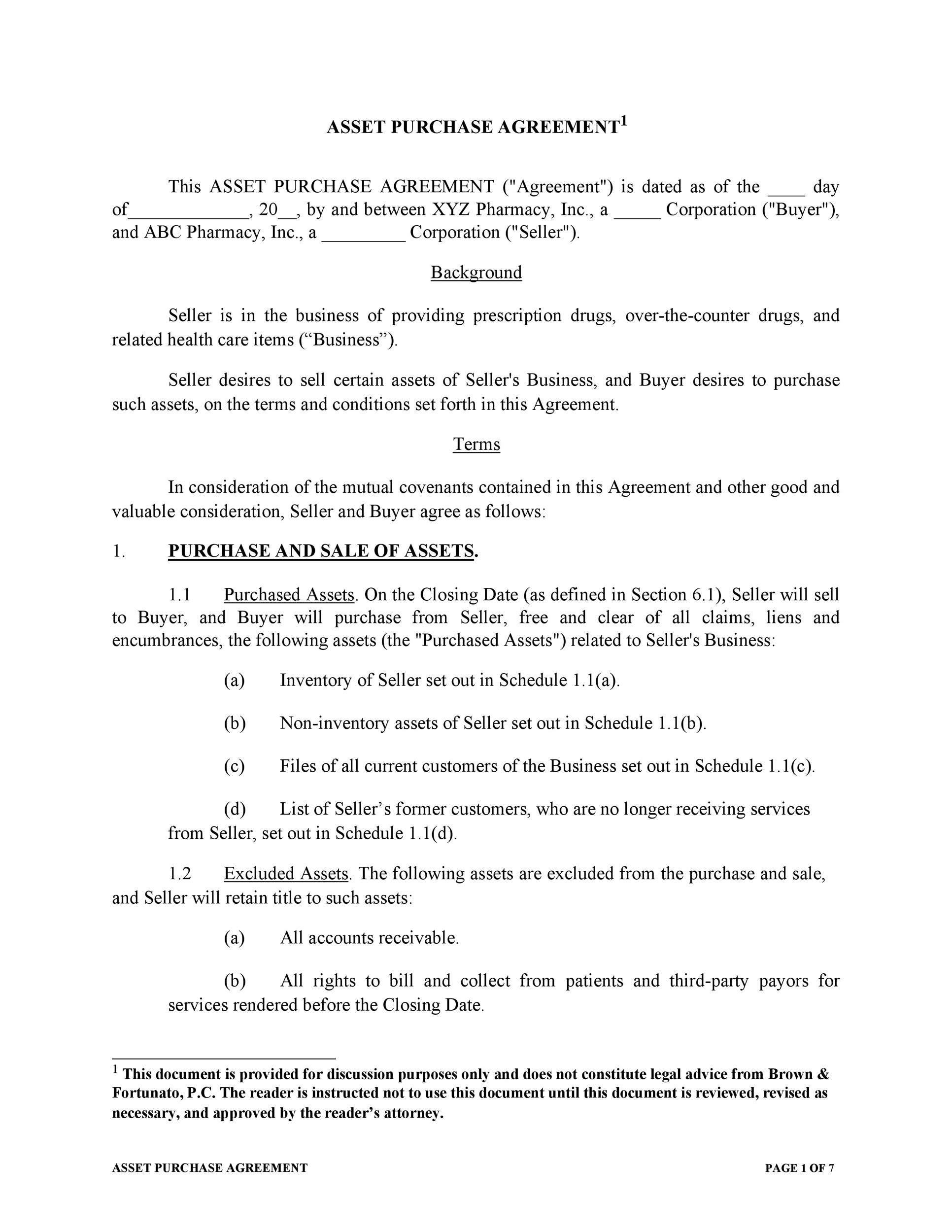

Professionally designed agreements are a key ingredient in any business relationship. Buyout agreement components An effective buyout agreement would normally contain the A buyout agreement can be incorporate into the company's bylaws and other paperwork, or it can be a Forced buyouts come in two basic forms: forcing co-owners to buy, and forcing a co-owner to sell. An Operating Agreement is a formal Use our LLC Operating Agreement to identify your business as a limited liability company and Some states don't allow licensed professionals to form LLCs — instead they must form a PLLC.