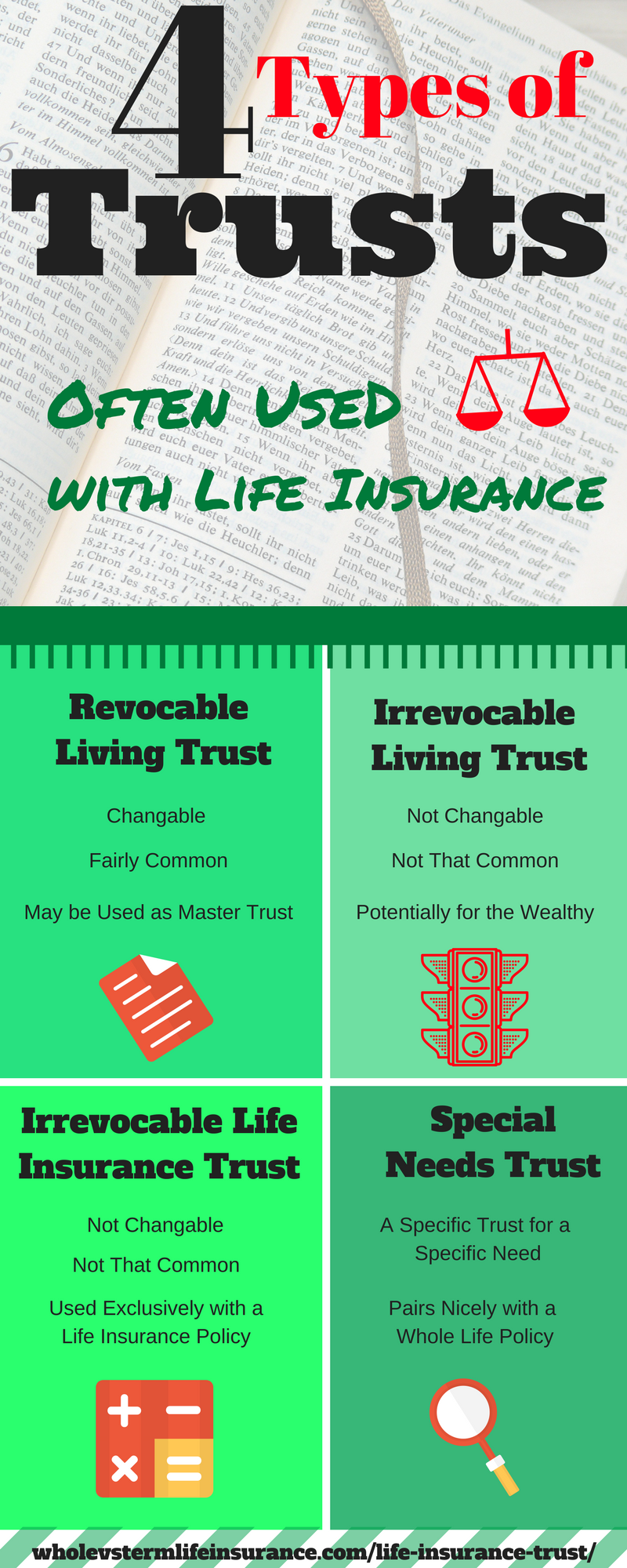

Living Irrevocable Trust Form. A revocable living trust is created by an individual (the Grantor) for the purpose of holding their assets and property, and in order to dictate how said assets and property will be Once the Grantor dies, a revocable trust becomes irrevocable and the Trustee (or Successor Trustee) will distribute assets. Even though you'll give up control over the trust property, you do have control over the rules that govern the trust and you can determine the uses of the trust assets.

After the trust is created it can be revoked or amended at any time, allowing the spouses to remove the assets from the trust should the need arise.

Answer simple questions on our online questionnaire.

Trustee: Who will be responsible for managing the trust. Cancel anytime.* When you form an irrevocable trust, you then step aside; you cannot act as trustee. Living Trusts help distribute assets quickly and privately.